Answering Your Questions

- Why are premiums going up?

- Where does the money go?

- Who makes sure insurers follow the rules?

- Can my state legislator change what my insurance pays for?

- How do we know our premiums pay for care?

- How much goes to salaries and administration?

- Do I pay taxes on health insurance?

- How does insurance work?

- How much of my premium goes to profit?

- Why are some our health premiums set aside in medical reserve?

Premiums are more expensive when care is more expensive. And unfortunately, that’s pretty much every year. Last year, Council member companies paid on average $877 every second for medical bills. Just a few years, ago medical bills were $600 a second. For all people with insurance through Council member companies, medical bills totaled nearly $28 billion in 2018.

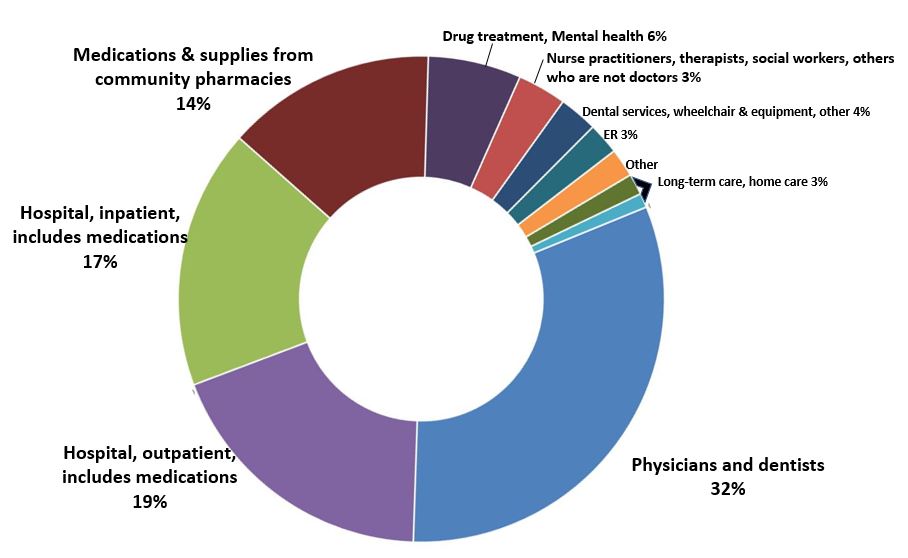

Right where you expect it to go—to pay medical bills. Here’s a close look at 2017:

It’s the state’s job to ensure that all rules are followed for most kinds of insurance. The state regulates everything from how Minnesotans get their insurance to how their medical bills are paid. For other kinds of insurance, the federal government is involved. Locally, the departments of Commerce, Health and Human Services oversee health insurers. Insurers are also subject to multiple audits and reviews.

Our elected representatives in the state legislature work to protect the health of every Minnesotan. But for most of us, rules for our health insurance are set in Washington, D.C., not in St. Paul. Most health insurance that Minnesotans get through their work is what’s called “self-funded,” and state laws don’t apply. Provided mostly by large corporations, “self-funded” means the employer uses its own funds—not an insurance company’s—to pay medical expenses. Federal (not state) laws govern this insurance. Federal laws also govern how insurers help pay for care for people with Medicare. About 17% of Minnesotans have this type of national insurance. About 25% of Minnesotans have private insurance that both state and federal laws govern. Minnesota’s lawmakers have direct influence on the way health insurance works for those who buy insurance on our own, or get what’s called “fully insured” policies through work. Both the state and federal governments set the rules for Medicaid, a type of insurance for about 17% of Minnesotans who are elderly, poor or live with disabilities.

By law, insurance companies file year-end reports on March 1 and April 1. Like financial reports prepared by governments and businesses, health insurers’ statements are audited, regulated by law, and are completed using standard accounting practices. The standards, rules and definitions come from the Financial Accounting Standards Board, National Association of Insurance Commissioners, and the State of Minnesota. The oversight and rules are designed to make sure the information is consistent over time and across organizations.

There is a huge penalty for any false information in filings. A company’s chief financial officer and chief executive officer must attest that the numbers are right. If false numbers are published, the company’s lead finance person could be put in jail. Literally put in jail.

We sometimes hear from people who doubt that all the money is shown in these reports. As a result, several additional audits look over the shoulder of the insurer’s own accountants and outside auditors. There are different kinds of reviews used for different purposes. Other organizations—both public and private—also analyze the data.

In the end, money paid to insurers pays medical bills. There are a lot of ways to compare how insurers pay for care, who gets paid and how much they get. The bottom line is still the same: our premiums are expensive because care is expensive.

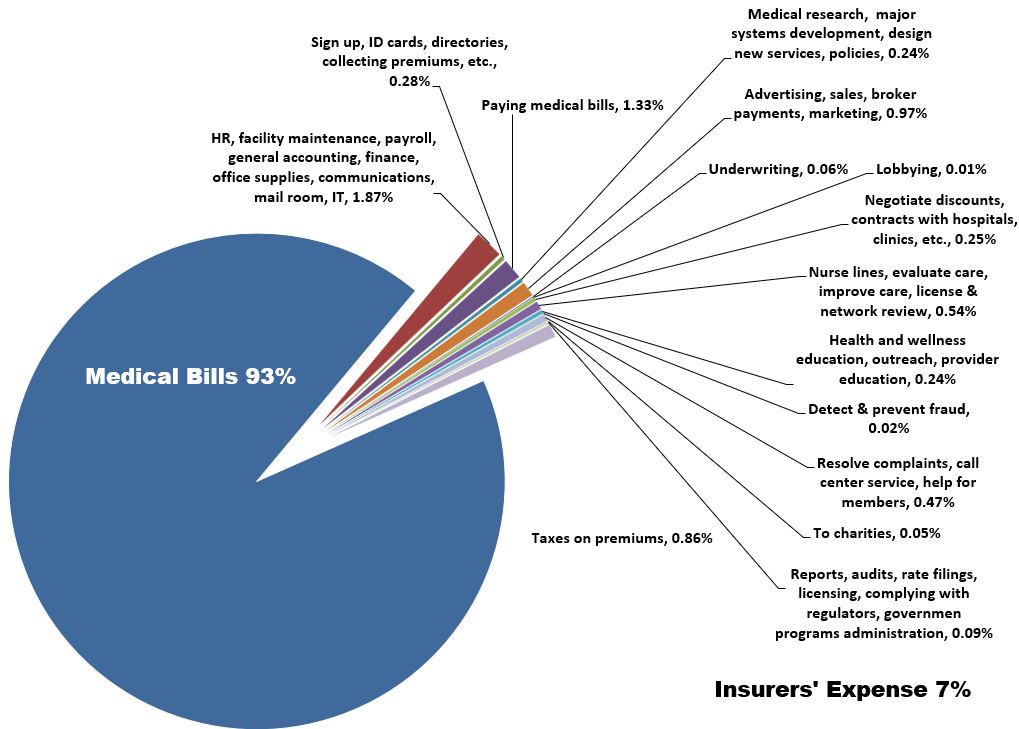

Out of every $100 we pay each month in premiums, about $90 pays medical bills. About $10 of our premiums go toward everything else it takes to keep insurance companies working. The Minnesota Department of Health requires health insurers to report administrative spending in 15 categories, ranging from taxes and assessments to customer service, fraud prevention and detection, and health and wellness programs. Minnesota health insurers have among the nation’s lowest administrative expenses: about 7-10% of premium revenue. That’s good news, because paying for care is exactly what premiums should do. There are state and federal laws in place to make sure premiums go to pay for medical care. The Minnesota Council of Health Plans, the Minnesota Department of Commerce, the Minnesota Department of Health and the Minnesota Department of Human Services all collect information about how our insurance companies spend the resources we’ve entrusted to them. Here is a closer look at the areas of administrative expenses and how the the Health Department tracks them. Many of the expenses inside an insurance company help make sure you get the best care possible. Employees inside these companies make sure people who give care are properly licensed and trained, evaluate the care we get, help policyholders get care, pay medical bills and more. Here is how the Minnesota Department of Health tracks administrative spending (data are for 2017):

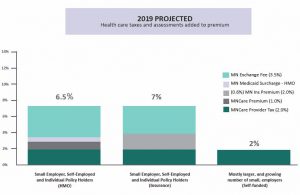

Yes. This chart shows how health insurance premiums in Minnesota are taxed. Minnesota’s small employers, farmers and other individuals pay more in health insurance taxes than large employers. That’s because federal laws exempt some employers from most state health insurance taxes. The only tax that is paid equally no matter how you get your insurance is what’s called the provider tax.

A few more details:

- The ACA Federal Industry Tax of 1.5-2.9% is not scheduled to be collected in 2019. It is scheduled to return in 2020.

- The 2% MinnesotaCare provider tax is assessed on medical bills, not premiums paid. Therefore, the portion of the premium that pays the provider tax is a little less than 2%.

- The chart does not include the Minnesota Medicaid surcharge on hospitals (1.56%) or other provider taxes and assessments that may be built into payments to those who provide your care.

- The chart does not include a federal fee on all employer-sponsored insurance that goes toward the Patient-Centered Outcomes Research Trust Fund. That fee is about $2.26 per person.

When you or your employer buys insurance, you pay a set fee, called a premium. The health insurer uses money from premiums to pay medical bills. The bills get paid even if a person’s care is more than the premiums he or she pays. The same concepts are in place when state or federal governments buy insurance on behalf of people who get help paying for care through Medicare, Medical Assistance or MinnesotaCare. Learn more here.

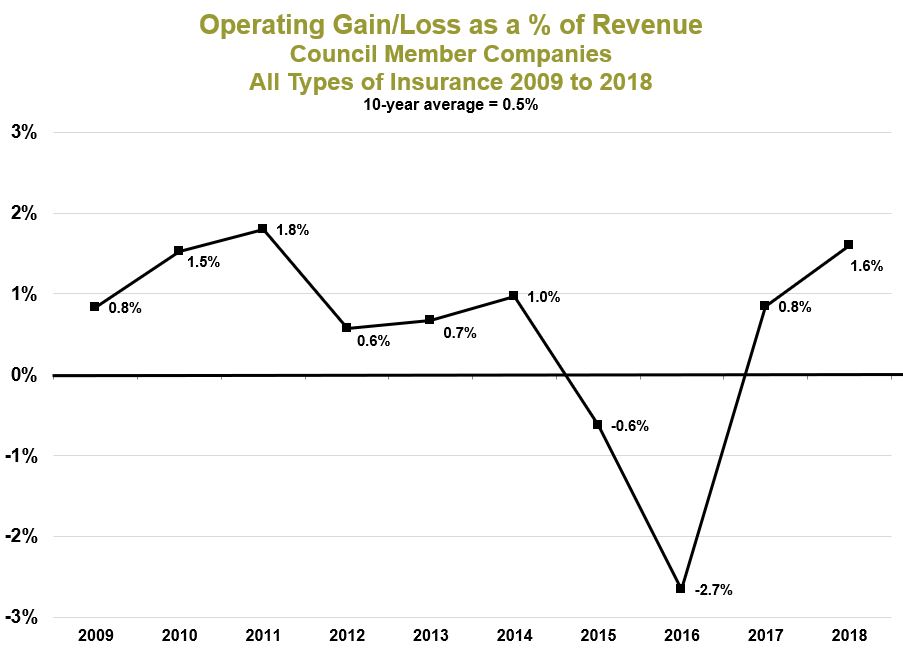

On average, less than 1% per year is left over after paying all the bills. This money goes into medical reserves to pay for unexpected expenses in the future. Unlike large national companies, Council members do not pay a dime to Wall Street shareholders. Here’s what profit (called “operating gain”) margins looked like the last few years for all the Council members combined.

When we pay our health insurance premiums, we expect our money to pay for medical care. So why do Minnesota’s health insurers set aside some of the premiums we pay? The answer is simple: Insurers need to save a portion of our premiums to make sure clinics and hospitals, home care companies and pharmacies get paid—even when times are tough. Being financially responsible means saving for a rainy day. All kinds of organizations—including counties and hospitals, factories and school districts, corner businesses and multinational corporations—set aside a portion of their income to make sure they can keep paying for care when facing unpredictable expenses and hard times. The same is true for Minnesota’s health insurance companies. The Department of Commerce monitors finances. As more people have health insurance and care keeps getting more expensive, medical reserves must grow to keep up. In all, the health insurers who work with the Council could pay for about three months of care with what they keep in medical reserves.