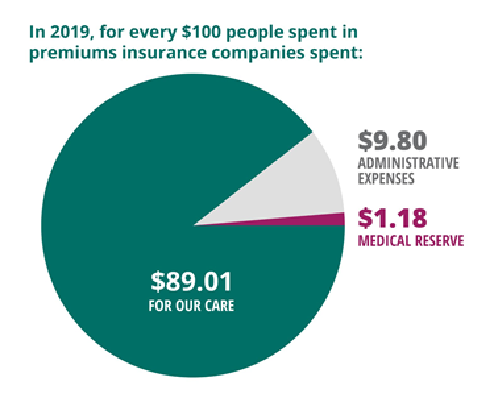

Minnesota’s seven nonprofit health plans continued supporting Minnesotans’ access to affordable, quality care in 2019, paying $13.98 billion in medical bills on behalf of 2.4 million people enrolled in fully insured or government programs, the Minnesota Council of Health Plans announced today.

Collectively, plans had an operating gain of 1.4 percent of revenue. As mission-based, nonprofit organizations, health plans use this revenue for the benefit of their member enrollees.

Collectively, plans had an operating gain of 1.4 percent of revenue. As mission-based, nonprofit organizations, health plans use this revenue for the benefit of their member enrollees.

This stability is important because it gives health plans the ability to maintain medical reserve funds, which they use to operate during large-scale emergencies and for other expenses. These funds will be especially important this year, as they will help plans support enrollees through the COVID-19 pandemic.

Health plans are already playing a leading role in safeguarding the health of Minnesotans amid the COVID-19 crisis. This includes eliminating cost-sharing for enrollees who need testing, expanding telehealth access and participating in a MNsure special enrollment period that gives the uninsured – including those who recently lost coverage due to a layoff – an opportunity to gain coverage.

“We recognize the significant public health threat that COVID-19 poses, and our health plans are committed to working with state and federal regulators so that enrollees have access to needed testing and treatments as quickly as possible,” said Lucas Nesse, president and CEO of the Minnesota Council of Health Plans. “Our priority is to ensure Minnesotans are getting access to the care they need.”

Reinsurance continues to cover high medical bills for those who buy their own insurance

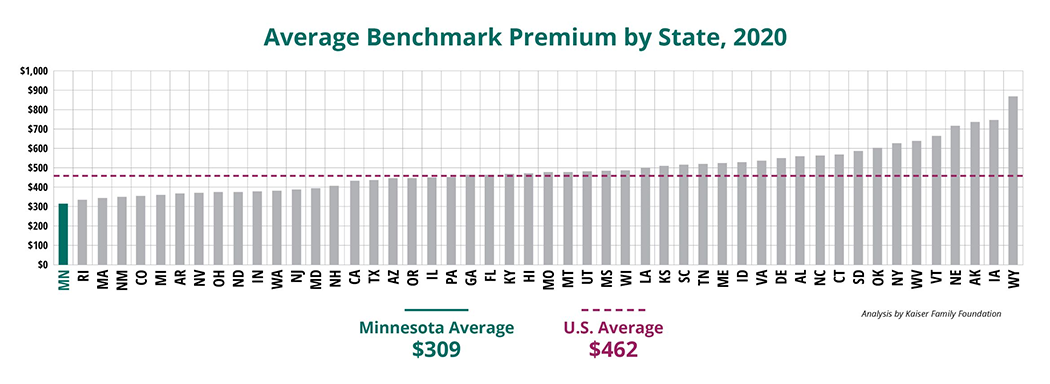

The State of Minnesota’s premium security program, known as “reinsurance,” also continued to help insurers cover those individuals with high medical expenses in 2019 so that these significant costs weren’t included in the premiums of other enrollees. This program makes premiums more affordable so that more family-based farmers, individuals and sole proprietors can access individual and family health plan coverage.

According to the Minnesota Department of Commerce, the reinsurance program led to individual market monthly premiums being, on average, 20 percent lower in 2019. Also, with the help of reinsurance, Minnesota premiums are the lowest in the nation.

Nonetheless, overall medical expenses for these Minnesotans rose 14.7 percent over 2018 to $630 million. Enrollment in the individual market rose to 143,858 in 2019, up 2.5 percent from 2018.

Nonetheless, overall medical expenses for these Minnesotans rose 14.7 percent over 2018 to $630 million. Enrollment in the individual market rose to 143,858 in 2019, up 2.5 percent from 2018.

“Reinsurance helped bring stability to the market that we may not have otherwise seen. And, with the current environment, stability will be more important than ever,” Nesse said.

Established in 1985, the Minnesota Council of Health Plans is an association of licensed nonprofit health insurers that includes Blue Cross and Blue Shield/Blue Plus of Minnesota, HealthPartners, Hennepin Health, Medica, PreferredOne, Sanford Health Plan of Minnesota and UCare. The financial results reported for 2019 are an industry average and therefore vary by individual health plan.