Since the early 1990s, the state’s tax on health care services has helped more Minnesotans get access to care.

This “provider” tax enables individuals who make less than $16,600 a year, and low-income families get care. It also helps farmers and other self-employed people who buy their own insurance. It even helps community health programs and sustain doctor training, too.

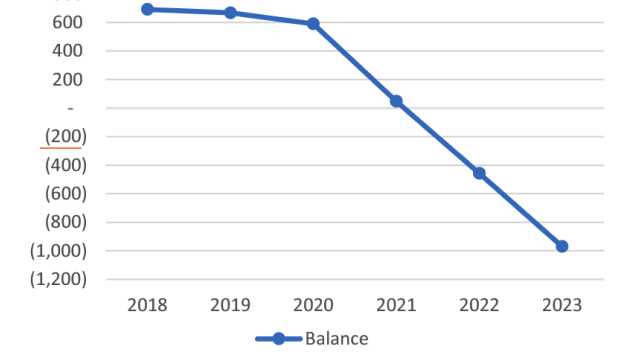

Source: Data from November 2018 Minnesota budget forecast

Source: Data from November 2018 Minnesota budget forecast