Why health insurance companies have medical reserves.

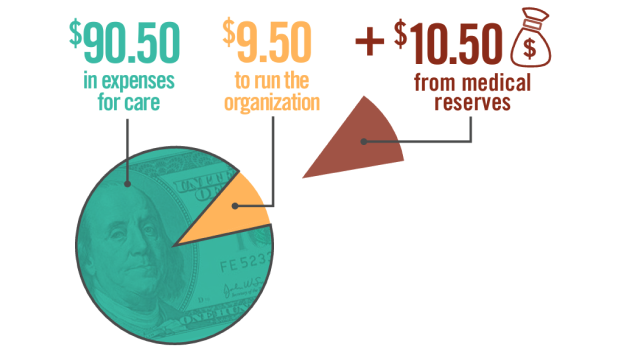

When we pay our health insurance premiums, we expect our money to pay for medical care. So why do Minnesota’s health insurers set aside some of the premiums we pay? The answer is simple. Insurers need to save a portion of our premiums to make sure our medical bills will always be paid, even when times are tough.